Where Are All the Expected Bankruptcy Filings?

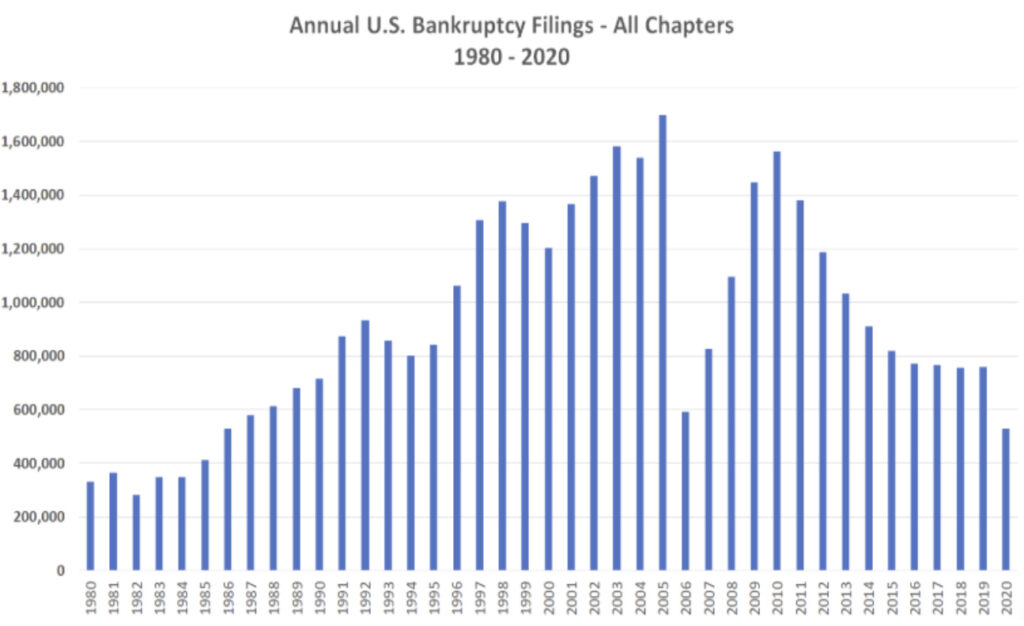

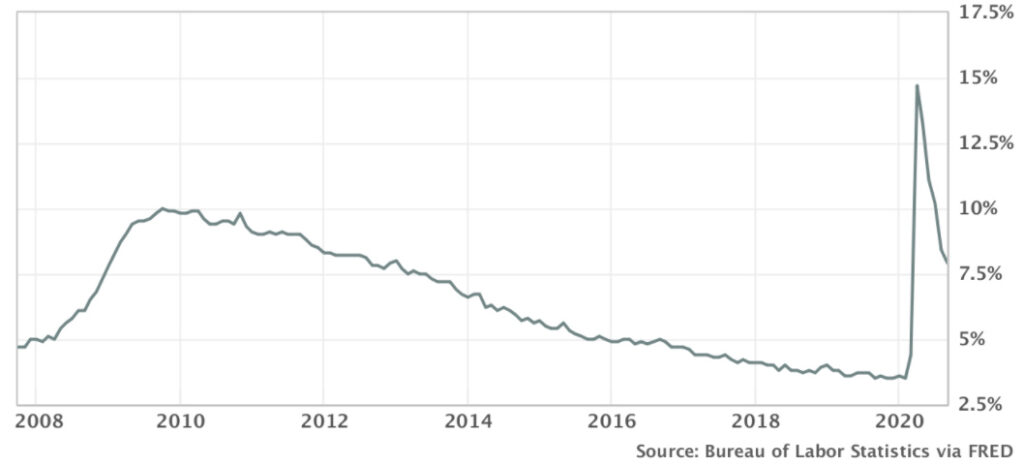

2020’s COVID pandemic has severely impacted the US economy, pushing unemployment rates to around 15% mid-year. In 2021, unemployment rates continue to hover around 7%. But Chapter 13s are down 45% from 2019, and Chapter 7s down 21%.

With so many people out of work and struggling, why has the demand for bankruptcy filings dropped? Traditionally, there is a direct correlation between unemployment rates and bankruptcy filings.

The current enigma

While many economists are considering the current period to be an enigma, they still believe it’s the “calm before the storm” for personal bk filings. “Liquidity in the form of government programs and state eviction moratoriums continues to delay new personal filings.” says Chris Kruse, senior VP of Epic AACER (published in GlobeNewswire.com).

Additional contributing factors to depressing the demand for personal bk filings are suggested to be government promises of additional financial relief, delayed visits to hospitals for medical care (thereby not generating new medical bills), and limited court capacity to process filings due to closures and virtual hearing schedules.

Regardless of why demand is currently being artificially depressed, filings are likely not to return to traditional levels until the pandemic has subsided — which may not be until at least mid-to-late 2021 at the earliest.

If your bankruptcy law firm is looking for more new clients during this time, consider contacting LeadQ to receive 10-50 additional qualified new client inquiries per month. LeadQ works on a simple Pay-Per-Qualified-Inquiry basis with a first-month 100% Risk-Free Guarantee.

Comments are closed.