How to Finance Your BK Firm’s New Client Generation at No Cost – And Create Positive Cash Flow

Maintaining positive cash flow for your bankruptcy law firm is crucial. Here’s how you can continuously generate new clients for your firm without paying for the efforts until you’ve collected your attorney fees.

Step 1: Generate incoming client prospects without paying upfront to generate them.

Step 2: Collect your full fee or an initial down payment and installments toward your fee prior to filing the case.

Step 3: Then, pay for generating those new clients after you’ve collected fees from them.

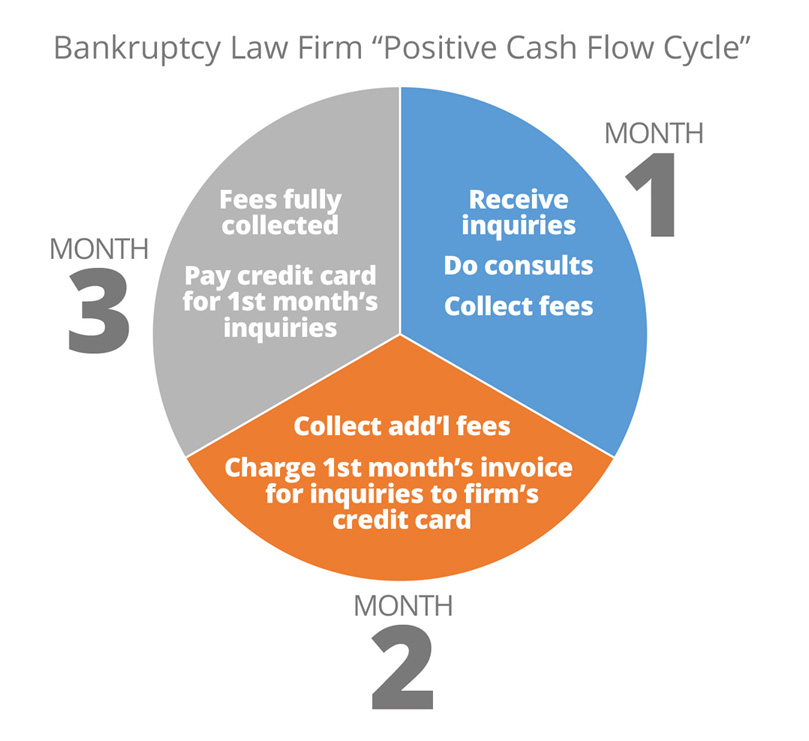

How the Positive Cash Flow Cycle works:

In Month 1, you or your lead generation partner generate new client inquiries for your firm. You conduct consults, sign fee agreements and collect all or partial fees.

In Month 2, you receive your invoice for the qualified inquiries that generated your new clients (if using a lead generation partner such as LeadQ that charges only for qualified inquiries). You collect additional fees from the new clients who are on payment plans. You also receive your invoice for the qualified inquiries that generated your new clients in Month 1, and charge that expense to a credit card — giving you another billing cycle before actually paying out-of-pocket.

In Month 3, you have collected additional fees from the remaining Month-1-generated clients on payment plans, and then pay the credit card charge for the lead generation services that generated those clients.

Even if you have not yet fully collected from your first month’s clients by the third month, the collections you have received will more than cover the marginal cost of generating those clients.

As you begin a new Positive Cash Flow Cycle each month, your receivables and incoming revenue stream grow, as does the volume of business your firm handles. Plus, those appointment prospects with whom you met but didn’t retain intially often return to you weeks or months later after they’ve gathered enough funds to file — further enhancing your firm’s caseload and cash flow.

Avoiding the Dangers

If you use marketing firms or lead generation companies that require you to pay upfront for the service, or in which the marketing fee is not directly related to the number of new clients the service generates, then this could severely impact your positive cash flow equation.

If you are required to pay upfront fees, you are essentially financing your own marketing risk – with the hope (i.e. not guaranteed) that new clients will result.

If you are required to pay for services in any way before you begin to collect from the clients the services generated, it also means you are financing your own efforts and risking your firm’s cash flow.

And if your marketing costs are not tied directly to the number of new clients the marketing generates – such as with “flat fee monthly” marketing arrangements, subscription participation programs and Pay Per Click search marketing — then again you are risking your positive cash flow – on the hope that it may pay off.

Using “Pay-Per-Qualified-Inquiry” Lead Generation with Delayed Payment

The Positive Cash Flow Cycle is a primary benefit of using Pay-Per-Qualified-Inquiry Lead Generation, as provided by LeadQ for bankruptcy law firms across the United States. LeadQ takes the risk in paying the upfront costs of generating new clients for your firm – allowing you to pay your final out-of-pocket expense for generating them AFTER you have had a reasonable length of time (about two months) to collect attorney fees.

Comments are closed.