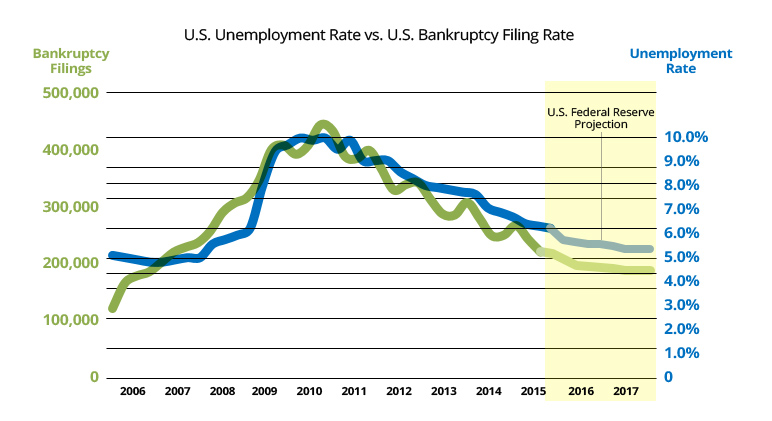

Bankruptcy Filing Trends: Using Unemployment Rates to Predict 2015

Since 2007, the U.S. bankruptcy filing rate has followed the same curve as the U.S. unemployment rate rather predictably. Both rates peaked in 2010 as a result of the great recession, and have since fallen steadily.

So how might bankruptcy filing trends continue into 2015 and beyond? Though no U.S. government agency releases projections of bankruptcy filing rates, several agencies do offer projections for the national unemployment rate. According to wsj.com reporting, the White House, Federal Reserve and Congressional Budget Office all forecast unemployment rates to stay in the mid-5% range in 2015, and continue to decline slowly over the next two years. By 2020, all three government forecasts show the unemployment rate forecasted between 5.1 to 5.3%.

Assuming the correlation indeed exists between unemployment rates and bankruptcy filing trends, the current filing rate of about 210,000 total filings per quarter will likely continue to decline slowly over the next three years.

By 2018, the U.S. may have approximately 180,000 total bankruptcy filings per quarter, a 14% decline from today’s filing rates.

Comments are closed.