2016 U.S. Bankruptcy Filing Trends: Have Filing Levels Bottomed Out?

In December, 2015, LeadQ published projections for U.S. bankruptcy filing rate trends for 2016 based on federal filing statistics. According to government filing reports to date, our projections appear to be on target.

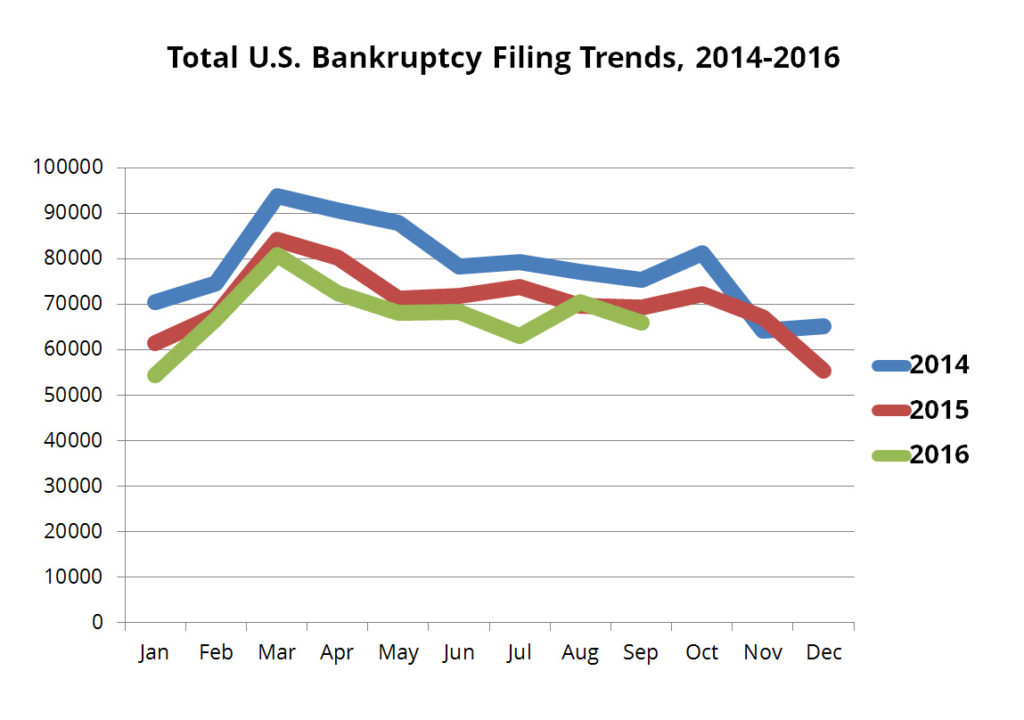

U.S. bankruptcy filing statistics for Q3, 2016, recently released on uscourts.gov, show actual filings were 199,417, a decrease of just over 13,000 from the same period one year earlier. July, somewhat of an anomaly in the overall trend, accounts for a little over 10,000 of the difference.

Based on nationwide filing numbers from August and September, US bankruptcy filing rates have essentially stabilized compared to Q3, 2015. This is consistent with LeadQ’s 2016 projection (see LeadQ article, U.S. Bankruptcy Filing Trends: Outlook for 2016).

With unemployment rates currently stable at 4.9% nationally, demand for filing bankruptcy across the country appears to have finally bottomed out.

While it is still too early to predict how a Trump presidency may affect the economy — and unemployment rates, which LeadQ has shown in previous articles to correlate with bankruptcy filing demand — it still remains likely that demand for bankruptcy will not fall further in 2017.

Fewer total filings, but more cases for your firm

While bankruptcy filing demand may continue to be weak, your firm may still be able to grow. In the last 12 months, bankruptcy law firms using LeadQ client generation have seen a 56% increase, on average, in the number of requests for bankruptcy consultations generated to their firms.

To find out more about how LeadQ can increase the number of bankruptcy cases your law firm receives, call us at 800-662-2888.

Comments are closed.