U.S. Bankruptcy Filing Trends: Where Filing Rates Are Headed in 2017 and Beyond

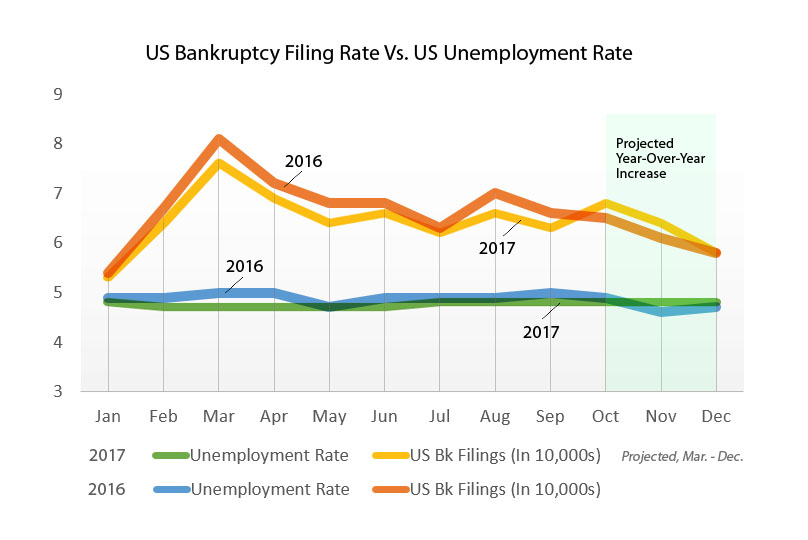

U.S. bankruptcy filing statistics for 2016 and current 2017 projections for the U.S. unemployment rate show the current trend of falling bankruptcy filings, year-over-year, appears to be ending in the coming months.

LeadQ has shown, in past postings, the correlation between bankruptcy filing rates and unemployment rates as far back as 2010. (See LeadQ 2015 article Using Unemployment Rates to Predict Bankruptcy Filings.) According to the Trading Economics global macro model and analyst forecasts (last updated March 13, 2017), the U.S. unemployment rate is currently forecast to remain at the current 4.7 percent through Q3 2017. It is projected by the TE, though, to rise to 4.8 percent in Q4 2018, with the trend edging upward to 6.0 percent by 2020.

The result, as notable to bankruptcy law firms, should be an overall increase, year-over-year, of bankruptcy filings in the U.S. in Q4 2017 over Q4 2016.

Additionally, Trading Economics’ global macro models of unemployement rates project a year-over-year increase in bankruptcy filing rates continuing over the following three years. As unanticipated economic factors can always affect future projections, LeadQ will continue to update our projections periodically.

Generating more cases for your firm

While bankruptcy filing demand may continue to be weak throughout much of 2017, your firm may still be able to grow. In the last 12 months, bankruptcy law firms who have starting using LeadQ for new client generation have received as many as 52 additional qualified new clients inquiring each month over their previous client-generation efforts.

To find out more about how LeadQ can increase the number of bankruptcy cases your law firm receives, call us at 800-662-2888.

Comments are closed.